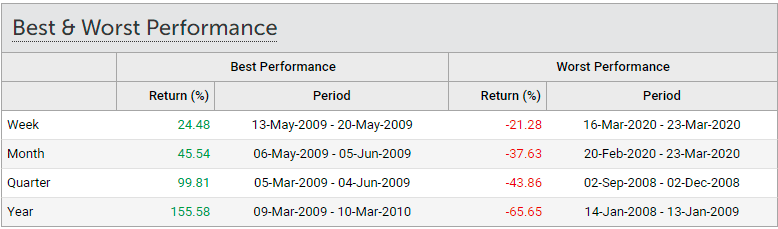

Today was a bad day for smallcaps. The Nifty Smallcap 250 index was down by 2.59%. No, this isn’t a post about “smallcaps are risky”. Although, I don’t who reads this thing, but I’ll say it – smallcaps are super risky. DSP Smallcap Fund was down 65% at the depths of the 2008 bear market.

But anyway, what was funny about today was that, for the first time I’ve been on Twitter, I saw the #smallcap trending. I’ve seen #Nifty trend multiple times in the past couple of years.

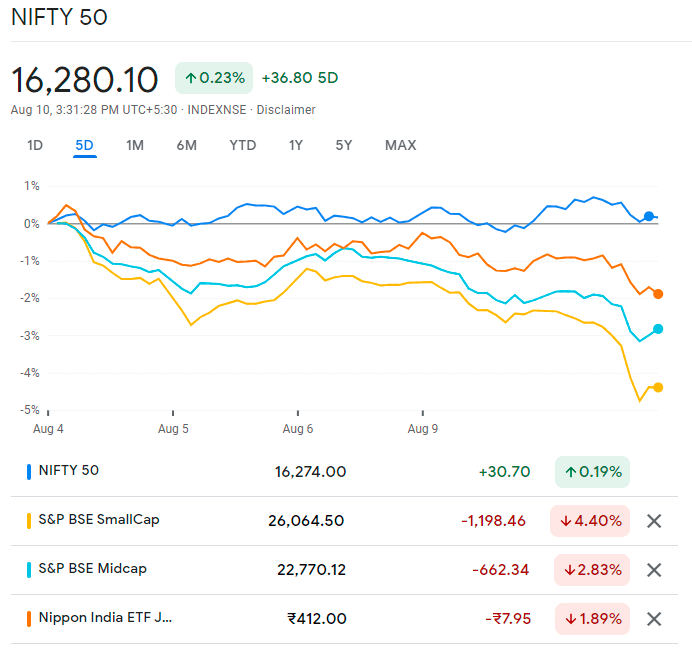

This was quite surprising given that the smallcap index is down just about 5%+ over the last week.

To put that into perspective, the Nifty Smallcap 250 index is up nearly 170% since its March lows. Even considering the fact that indices hide some of the sharper falls in individual smallcap names, this was funny.

This is quite interesting if you think about it. This year, the GameStop and the AMC sagas highlighted the power of social media in accelerating the trends in the US. We haven’t had similar social media power manias around stocks in India, except for the displays of euphoria whenever ITC crosses Rs 200.

Just like the rapid financialization of everything from art to sneakers and Pokemon cards in the US, we are seeing the beginnings in India. It’s still a small market with just about a couple of crore unique investors. Most of the money is still stuck in FDs. But financialization is picking up pace for sure.

But in the last couple of years, I get the sense that social media and messaging platforms like Telegram and WhatsApp have been having a measurable influence on stocks, mostly garbage penny stocks. But with #smallcaps trending today is any indication, I think, things will be more fun in the days ahead in bigger stocks. In all likelihood, social media platforms may substantially accentuate trends both on the upside and on the downside.

There’s plenty of research [1, 2] that shows the impact of social media chatter on volatility, turnover and shorting. Most of this is in the US, but with hypersocialization, I have a feeling we’ll see some fun incidents in the Indian markets soon.

This also raises the question of what should the regulators do, just like we saw in the case of the SEC at the height of the GameStop mania, but this is a tricky issue, to say the least.

But assuming we see the amplification of trends due to social media, a good time to be a trend follower or a momentum investor/trader?

Leave a Reply